Financing

June 2, 2022

Categories

Should you pre-qualify for a home loan before looking at homes? Unless you are paying cash, the answer is yes. Buying a home can be fun and exciting. It can also be very challenging if you are not prepared. There are definite steps to preparing your finances for this process, and while it seems like a lot of work, and it can be, it will pay off when you are […]

April 7, 2014

Categories

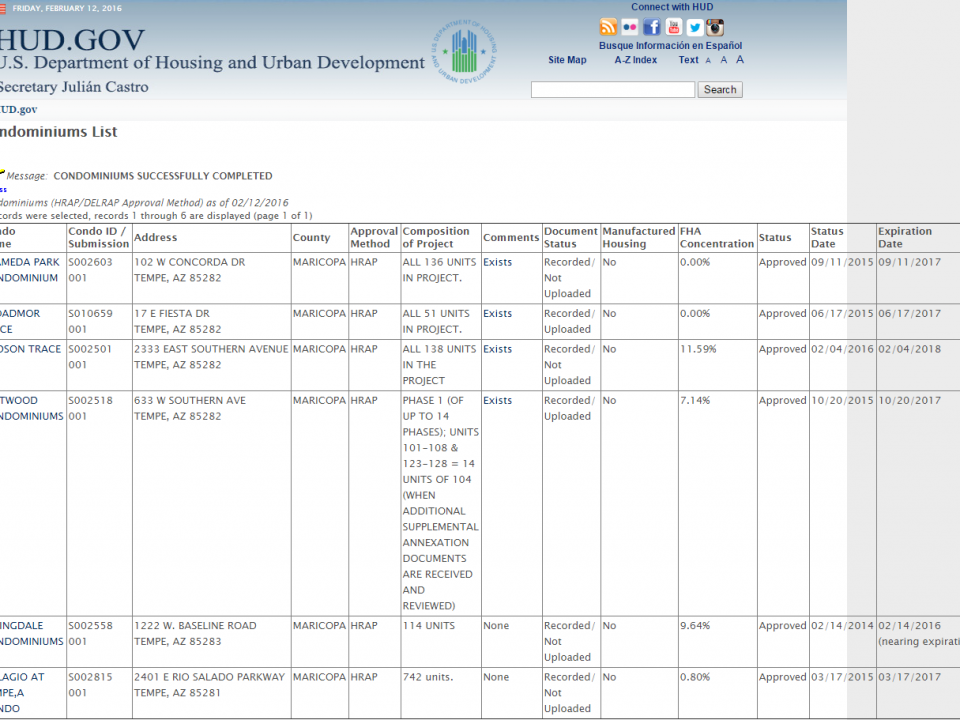

It is a common misconception that all homes qualify for all types of financing. Many buyers wanting to utilize a low down payment mortgage to purchase a home look to an FHA loan because of its 3.5% down payment option. Unfortunately, if buyers are looking to purchase a condominium instead of a single family home, their options can be limited to condos that “qualify” for FHA financing. While the guidelines […]

July 15, 2012

Categories

In another sign of economic recovery, Phoenix IDA & Maricopa County IDA have teamed up with Morgan Keegan to bring the Home in 5 down payment assistance program back to us here in the Metro Phoenix market. In 2006 and 2007, the Home in 5 program helped over 2200 families with a 5% grant to be used towards the expenses of down payment and closing costs when purchasing a home. This […]

February 3, 2012

Categories

You have probably heard the term “Cash is King” many times. Well, it is probably true! 🙂 Last year was a year where home prices were low and interest rates were lower. While the media kept perpetuating the idea that homes were barely selling during much of 2011, numbers released by the Arizona Regional MLS show that 2011 saw the second highest number of homes sales this century, which was […]

March 16, 2009

Categories

Distressed properties – A large part of our current market. The Arizona real estate market, like many others, continues to change at a rapid pace. While the trend is currently looked at by many as “distressing,” there are those who look at this market as an opportunity to purchase real estate in an environment of low interest rates and at price levels not seen for quite some time. One of […]

August 16, 2008

Categories

Recently, I wrote about some of the potential changes coming up for down payment assistance. My friend Tammy wrote an article and posted this video yesterday with some more information. I thought it was pretty interesting.

July 31, 2008

Categories

The changes in the mortgage industry have been coming at a break neck pace. Unfortunately, some of the people that vote on the bills don’t appear to have time to pay attention. When my friend Gary Miljour wrote to our Congressman Harry Mitchell asking about Down Payment Assistance loans, such as “Ameridream,” did he really say; “Unfortunately, some companies that provide down payment assistance were helping lenders to make predatory […]

July 5, 2008

Categories

I have talked to many people recently about one area of major concern in the lending industry. The term is “Buy and Bail” and it can have an effect on all of us. On Wednesday of last week, I received an email from a friend at Wells Fargo that talked about some of the coming changes dealing with people that want to buy another home while keeping their current home. […]

February 25, 2008

Categories

Tens of thousands of people have been getting letters informing them that their HELOC loan is no longer available or has been substantially reduced. Yep, fine print at it’s best. You may recall how these same banks offered these loans at “no-cost” and marketed them as a great tool for you to use for college, cars, home improvements and even credit card debt. It sounds like their irrational exuberance has […]