Details Do Matter

In a residential purchase contract, the details do matter…

Sometimes, I am surprised by how many agents don’t pay attention to how a purchase contract works or how seemingly small details can raise questions.

For example:

Page 1 of our residential resale real estate purchase contract has a specific section for filling out the “Full Purchase Price” of the home and how it will be paid.

For example, line 10 states:

10. $__________ Full Purchase Price, paid as outlined below.

This line is where the amout of the offer goes. The following line is where the amount of earnest money is reflected.

11. $_________ Earnest money

Lines 12 and 13 simply read:

12. $________

13. _________

TYPICALLY, on financed offers, these lines show the additional amount of the down payment and the amount that will be financed.

For super easy example, let’s use a $400,000 house with a 10% down payment. The breakdown might look like this:

10: $ 400,000 Full Purchase Price, paid as outlined below.

11: $ 4000.00 Earnest money

12: $ 36,000 Paid in certified funds at close of escrow.

13: $ 360,000 Financed by 30 year Conventional loan

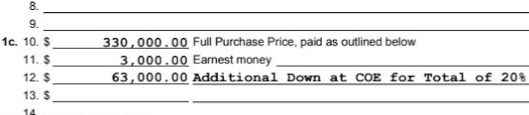

Recently, we got an offer from an agent that read like this:

10. $330,000 Full Purchase Price, paid as outlined below.

11. $3000.00 Earnest money

12. $63,000 Additional Down at COE for Total of 20%

Do you see what is missing from the example above? Yep, line 13 was left blank. There is nothing that states the amount that will be financed.

The contract should always be very specific, so I asked the agent the following questions and he gave me the following answers:

Me. “Can you add the loan amount to page 1?”

Agent “On which document? Page one on Prequal?

Let me know and I can adjust.”

Me. “Typically, page 1 of the contract has a loan amount.”

Agent. “I’m not familiar with this. Like the loan prequal amount, shown in the Loan Prequal. Again, sorry I’m not familiar with this setup on page one of contract. If you want to send over an addendum showing what you need or send me an example and let me know what that looks like, I’ll put that together and get it sent over.

Does the preqaul need to be adjusted to show a different amount?”

Me: Typically, there is offer price, earnest money, down payment and loan amount on page 1. Lines 10-13 of the contract.

I have owned and flipped over 100 properties and as long as the prequal shows the required loan amount this hasn’t been an issue.

Are you asking that I add a line below the escrow amount of 20% down that shows the final loan amount?

Again, I don’t mean to sound glib but I have never had someone ask this of me.

Me to myself. Wow…